Greetings from Scoutable and welcome to our February Wrap Up.

Across Sydney, Melbourne and Brisbane, auction numbers are climbing as the market gets back into swing after the festive break. The data below shows a drop in clearance rates of 10% in Sydney, 21% in Melbourne and 8% in Brisbane, for the February year on year comparison.

February saw 1,766 properties scheduled for auction across Sydney, with an average clearance rate of 58%. Melbourne saw 2,227 properties scheduled, with an average clearance rate of 51%. Brisbane saw 353 properties scheduled for auction with an average clearance rate of 40%. In comparison, February last year had an average clearance rate of 68% (3,141 properties), 72% (3,675 properties) & 48% (1,050 properties) respectively.

Yesterday, I attended the Australian Property Institute’s Property Market Outlook for 2019 seminar. Besa Deda, Chief Economist of St George, provided her overview for the residential market and general economic outlook.

Besa discussed the four main issues effecting the global economy, which included economic and political concerns in the USA, USA/China trade tension, Brexit and Italy falling into a recession.

Nevertheless, world growth looks good.

In regards to the Australian Economy, Besa mentioned the economic growth forecast has been cut by the Reserve Bank. Whilst the cash rate is on hold for now, there are scenarios for both a cash rate rise and a cash rate cut towards the end of 2019. Overall consumer spending and the property market are down but business spending is good. She believes there will be a cash rate cut in December 2019.

The housing downturn has been led by Sydney and Melbourne. Sydney is down 12% since the peak 18 months ago, Melbourne is down 8% since the peak 14 months ago. Besa points out that on average there has been a 70% rise in property prices over the last five years, thus a 12% drop is not so bad. She mentioned the downturn is unique as it has not been driven by increased interest rates but more so by Government policy, foreign demand decrease, the Royal Commission, lending conditions and in some areas an oversupply of new build apartments.

Should the Labor party win the upcoming election, there will be a few changes for the property market which will include a change to negative gearing. Labour proposes that negative gearing will only apply to new build properties. All existing investment properties will be grandfathered from this ruling.

Overall, NSW has a good report card from Besa. NSW is the fasting growing state in Australia, supported by infrastructure, spending and population growth.

As always, our advice is that property is a long-term hold. There will always be movement in the market. The key is to not over extend yourself, buy in ‘blue chip’ locations (close to transport, retail facilities, CBD, schools, universities, hospitals) and do your research.

If you would like to discuss the current conditions of the market further, or are thinking of buying or investing in Australian property, get in touch to learn about Scoutable's services and how we can assist with your property search.

Until next month,

Kellie Landrey | Principal Buyers Agent

IN THE NEWS

THE BANKING ROYAL COMMISSION AT A GLANCE

PARENTS STILL UNHAPPY WITH REVISED SCHOOL CATCHMENT

ROSE BAY HOME SELLS FOR $23.5M AFTER PASSING IN AT AUCTION

PROPERTY OF THE MONTH

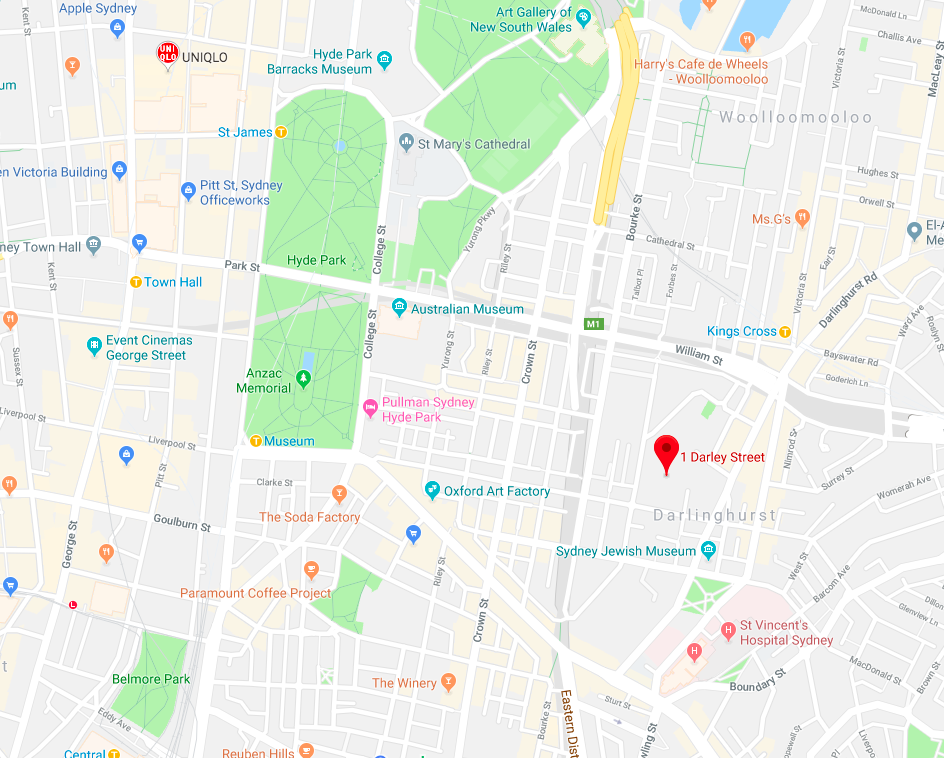

16/1 DARLEY STREET DARLINGHURST

February’s property of the month is a great little investment apartment. 16/1 Darley Street Darlinghurst is located 1.9km from Sydney's CBD. Nestled in the back of the block, the apartment is 37sqm internally, comprising open plan kitchen / living / dining, bedroom, bathroom and access to a disused fire escape providing a small alfresco stoop to enjoy your morning coffee.

The price guide is $490,000 with a rental guide of $490 per week. Should these figures be achieved, the resulting gross yield would be 5.2%. The outgoings equate to $4,280 per annum, which covers strata fees, council rates and water rates, resulting in a net yield (before management fees and insurance) of 4.3%.

The complex was built in the 1930s, with 20 apartments in the block. Positioned in a tree lined cul-de-sac, it's within walking distance to restaurant and retail facilities of Darlinghurst, Surry Hills, Paddington and Potts Point and well as St Vincent's Hospital, National Art School, Kings Cross Station and the CBD.

Properties like this provide a great opportunity to enter the Sydney market due to their enviable location and high rental demand ensures they are hardly ever vacant.

It's important to note than some banks require a minimum internal space of 40-50sqm as part of their lending criteria so it's worth shopping around for the right loan if you're looking into purchasing a small property.

If you'd like to know more about this property or any others, please get in touch.