Greetings from Scoutable and welcome to our April Wrap Up.

I hope you and your loved ones are well.

April is usually a slow auction month due to school holidays, Easter and Anzac Day. This year, it is further exacerbated by the current COVID-19 environment including auction restrictions. Given the current climate, it is more relevant to compare week on week auction results rather than year on year trends.

Last week (ending 26th April) Sydney saw 192 properties scheduled for auction with a clearance rate of 51%, Melbourne saw 144 properties scheduled for auction with a clearance rate of 28% and Brisbane saw 28 properties scheduled for auction with a clearance rate of 23%.

The week ending 19th April saw 735 properties scheduled for auction in Sydney with a clearance rate of 34%, Melbourne saw 1,016 properties scheduled for auction with a clearance rate of 28% and Brisbane saw 75 properties scheduled for auction with a clearance rate of 19%.

The last few weeks have seen a high proportion of properties withdrawn from auction. It is most likely that these properties were listed before COVID-19 restrictions. It will be interesting to note the clearance rates in the coming weeks as these properties would have been listed under the cloud of COVID-19.

Eliza Owen, Head of Research at CoreLogic, reported on the 23rd April that the biggest impact from COVID-19 on the property market to date has been on listing volumes. Eliza mentioned that the value of dwellings has been relatively resilient (although it is still likely that property values will fall amid the economic downturn). CoreLogic chart below shows the rolling 28-day change in dwelling values (combined capital cities), ending 21st April. The change in value is 0.4%, however, the positive growth rate has slowed from 1.1% mid-March.

Eliza Owen commented that so far there is no evidence of distressed selling. Eliza said: Listings volumes, rather than reflecting an influx of supply to the market, are very low. In the 28-days ending 19th of April, new listings volumes were 28.7% lower than they were in the same period last year. The total listing stock of dwellings for sale in the same measurement period were down 23.8%. See graph below.

Like many others, I was expecting the results to show more of an overall reduction in property values. Stock levels will play a major role in assisting properties to hold value. Currently, the uncertainty in the economy is giving reason for many sellers to hold tight and wait to sell until COVID-19 is behind us, as seen above in CoreLogic new listings graph. The less than expected influx of distress properties coming onto the market could be due to many banks offering a pause on mortgage repayments. It will be interesting to see supply levels once the bank repayment pauses are lifted.

It is possible the property market will take time to recover because a global recession recovery in not a fast process. It is likely our unemployment rate will remain elevated for several years. Net overseas migration is likely to be far lower over the coming years than the past decade. Our mortgage rates can’t really get much lower and there is likely to be an increase in rental supply with short term rental properties converting to the long term offerings.

Reserve Bank Governor Philip Lowe on the 21st of April, suggested by June 2020:

National economic output was likely to fall by 10%;

Total hours worked would fall around 20%; and,

The unemployment rate could reach 10%.

Should Governor Lowe's predictions come true with people out of work or work hours reduced, affordability to service loans could come under pressure. This could mean more people may have to sell their homes or investment properties. It is possible, we will not see the COVID-19 effects for some months to come.

In conversations with various selling agents, the main reasons people are selling at the moment are to upgrade/downgrade, selling because they are worried the market will fall further, and expats wanting to sell before the expat capital gain tax deadline of 30 June.

From the trenches, over the past week Scoutable has been involved in three negotiations for properties in the Inner West, Inner City and Inner East of Sydney. All properties sold before the scheduled online auction with competition from three – five other buyers on each property. Each property sold at the lower to mid end of a 10% value range we placed on the properties. We are seeing a discount of between 2% – 10% from February 2020 prices but strong competition at the discounted level.

Ultimately, what will drive property prices over the coming months will simply be a matter of supply and demand. That is, if stock levels remain tight, property prices could remain firm. If stock levels increase and buyer demand reduces, prices could drop. Our advice is that if your employment is not affected and the goal is to hold the property long term, then there are good opportunities to buy now with an appropriate discount applied on price.

If you are thinking of buying or investing in Australian property, get in touch to learn about Scoutable's services and how we can assist with your property search.

Until next month,

Kellie Landrey | Principal Buyers Agent

IN THE NEWS

UPSIZERS, FIRST HOME BUYERS HOLD UP MELBOURNE PROPERTY MARKET DURING CORONAVIRUS PANDEMIC

https://www.domain.com.au/news/upsizers-and-first-home-buyers-holding-up-melbournes-property-market-during-coronavirus-950654/

PROPERTY LISTINGS PLUMMET 22%

https://theurbandeveloper.com/articles/australian-house-prices-up-listings-plummet?utm_source=TUD+Master+List&utm_campaign=9a9ba67a8b-EMAIL_CAMPAIGN_2019_07_03_11_11_COPY_01&utm_medium=email&utm_term=0_9f25b32131-9a9ba67a8b-195555625

RETAIL PROPERTY APOCALYPSE UNFOLDING

https://www.smh.com.au/business/companies/a-retail-property-apocalypse-is-unfolding-and-it-s-going-to-be-unpleasant-20200429-p54o7t.html

PROPERTY OF THE MONTH

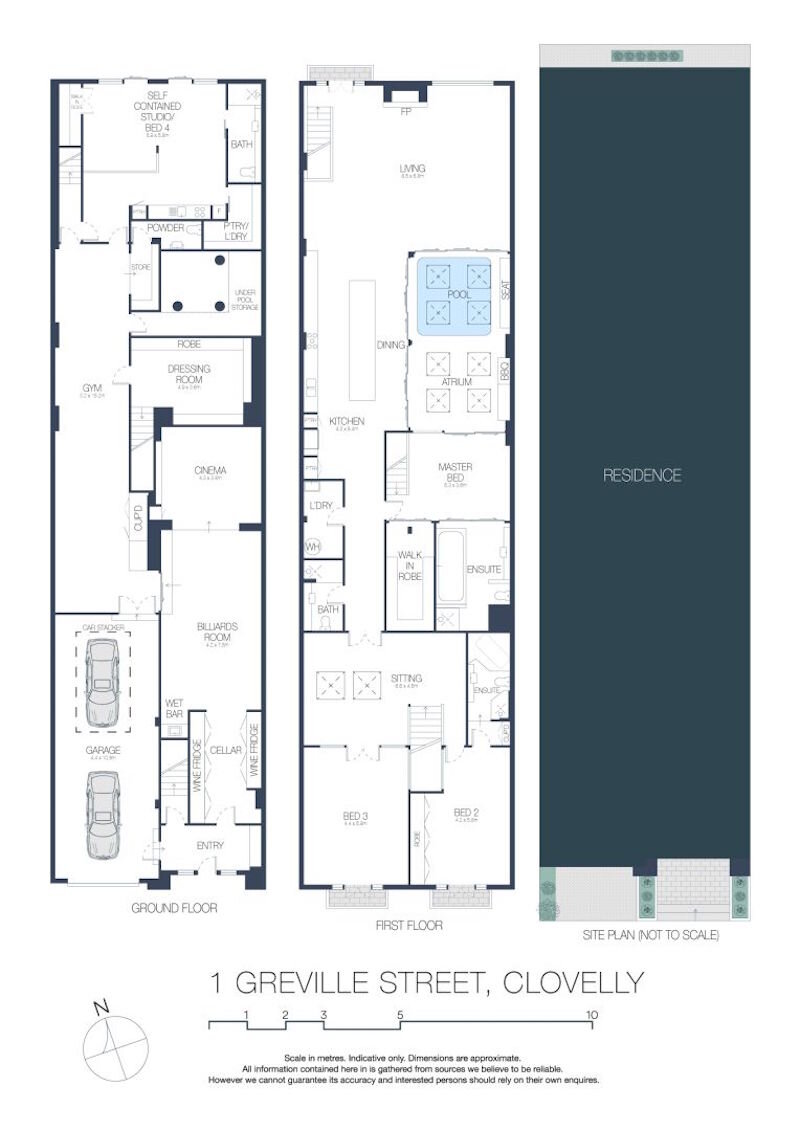

1 GREVILLE STREET, CLOVELLY

Clovelly is located 8km south-east of Sydney’s CBD, between the suburbs of Bronte and Coogee. It is known for its great lifestyle offering with easy access to many beautiful beaches, retail amenities and coastal walks. The property of the month is known as ‘The Stables’. It is a former horse stable, built in the early 20th century. The property has been converted into a unique family home by Fiji resort operator Henry Crawford, using globally sourced materials. Situated on 342sqm of land, the floor space is an impressive 560sqm arranged over two levels. The upper level provides three bedrooms, three bathrooms, open plan kitchen / living / dining and plunge pool. The ground floor accommodates parking for three cars (tandem and stacker), wine cellar, billiards room, media room, dressing room / storage, WC, gym and self-contained studio. The property last sold in December 2014 for $3,000,000. It is now for sale with an asking price of $5,500,000 - $6,000,000.

If you'd like to know more about this property or any others, please get in touch.