Greetings from Scoutable and welcome to our February Wrap Up.

I hope you and your loved ones are well.

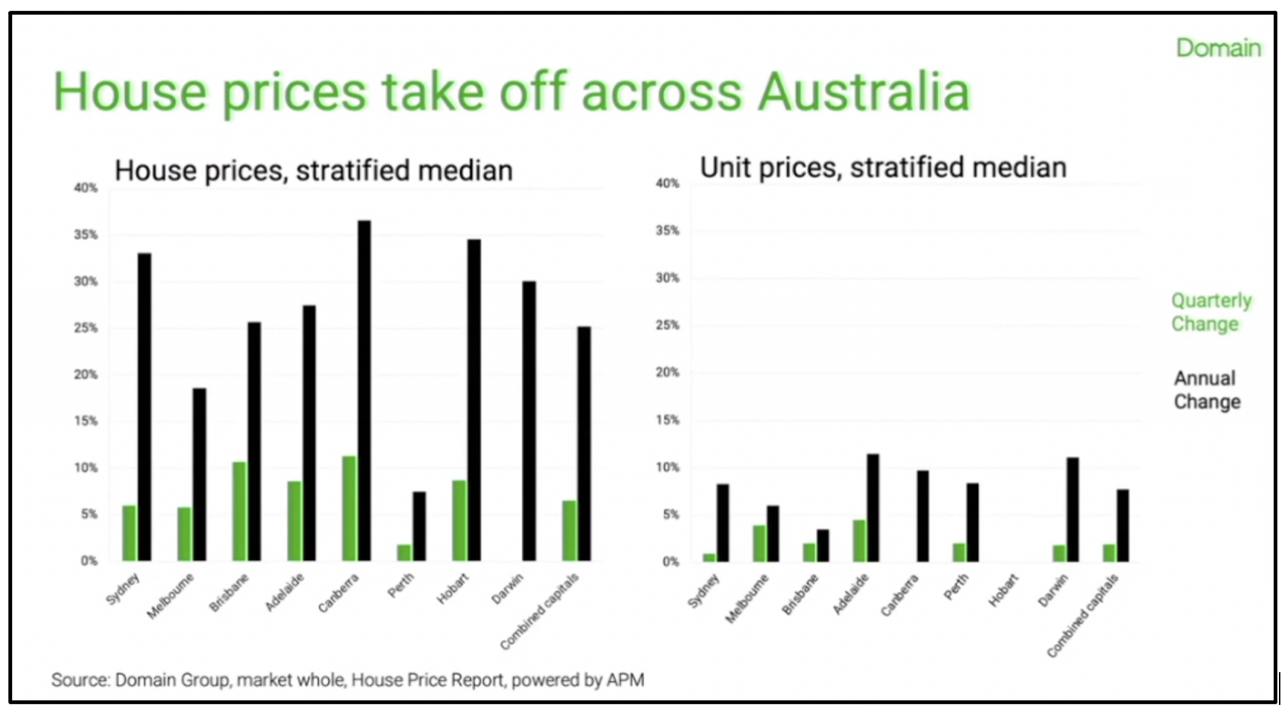

Domain House Price Report for the December 2021 quarter (released in January 2022) summarised the capital growth results across Australia for 2021. The below graph highlights the extreme growth achieved. The combined capital cites reported an annual growth of 25.5% for houses and 7.7% for units.

The capital growth experienced in 2021 can be attributed to record low interest rates, improved affordability following 2017-2019 reduction in housing values, higher levels of housing sentiment, surge in household savings during lockdown, the imbalance between supply and demand, and government policies that supported housing activity. Many of these factors are losing their strength to drive the market.

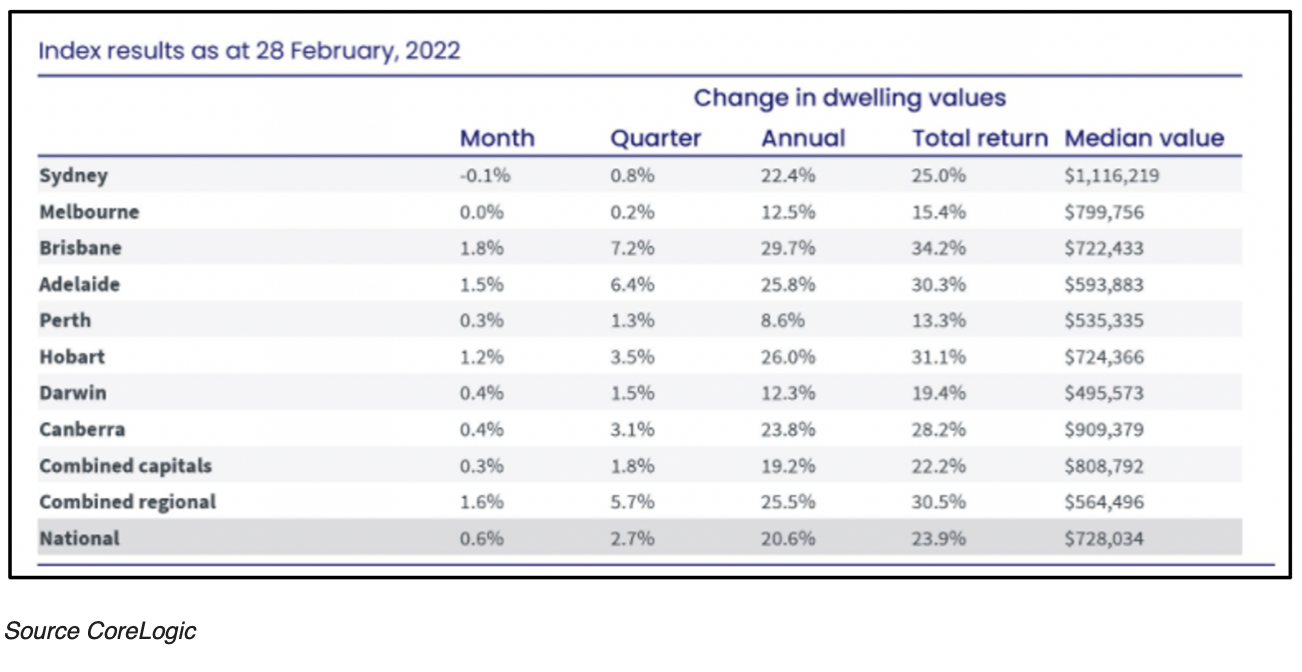

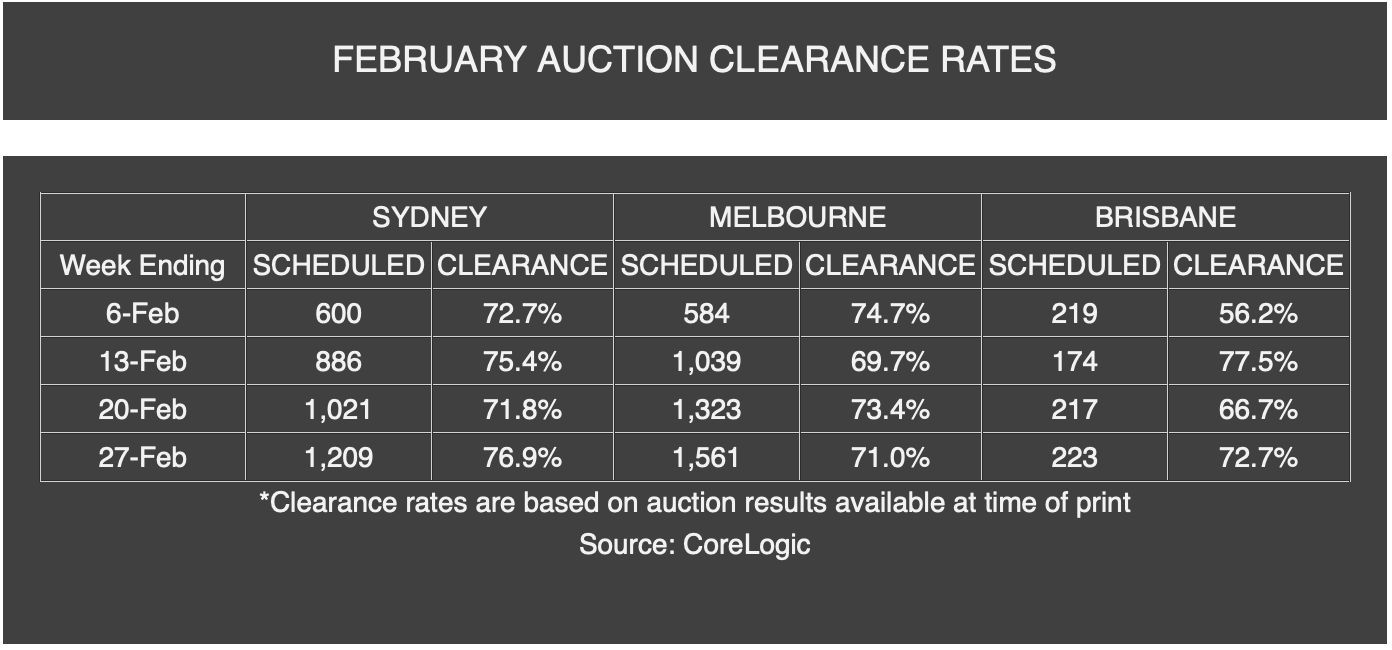

CoreLogic’s national Home Value Index (HVI) for February 2022 posted a 0.6% gain, the 17th consecutive monthly increase in the national HVI. While housing values are generally rising, the pace of growth in the national index has trended downwards since April last year. February’s growth of 0.6% marks the lowest monthly growth reading since October 2020, and is down from 1.1% in January and a peak of 2.8% in March 2021.

CoreLogic research director Tim Lawless noted “The slower growth conditions in Australian housing values goes well beyond the rising expectation of interest rate hikes later this year. The pace of growth in housing values started to ease in April last year, when fixed-term mortgage rates began to face upwards pressure, fiscal support was expiring and housing affordability was becoming more stretched. With rising global uncertainty and the potential for weaker consumer sentiment amidst tighter monetary policy settings, the downside risk for housing markets has become more pronounced in recent months.” Mr Lawless commented further “Consumer sentiment could be further negatively impacted by Russia’s invasion of Ukraine, triggering a new wave of global uncertainty.”

Whilst the above factors are impacting the pace of growth in Australia, there are some factors which will protect the market from a complete downturn. These factors include a lift in migration, improving economic conditions, wage growth, and the opening of domestic and international boarders. CoreLogic noted “While a return of overseas travel is not expected to boost home buying demand immediately, we are expecting stronger rental demand in key areas such as inner-city precincts popular with foreign visitors and students”. This in turn will attract investors to those areas.

If you would like to discuss the current market conditions further, please get in touch.

Until next month,

Kellie Landrey | Principal Buyers Agent

IN THE NEWS

AUSTRALIAN HOUSE PRICES KEEP GROWING BUT SYDNEY POSTS FIRST FALL IN 17 MONTHS

RBA TO GRADUALLY INCREASE RATES TO AVOID MORTGAGE SHOCK, TOP ECONOMISTS PREDICT

THIS 'RUIN' IS THE HOTTEST HOUSE IN AUSTRALIA RIGHT NOW

https://www.realestate.com.au/news/this-ruin-is-the-hottest-house-in-australia-right-now/

PROPERTY OF THE MONTH

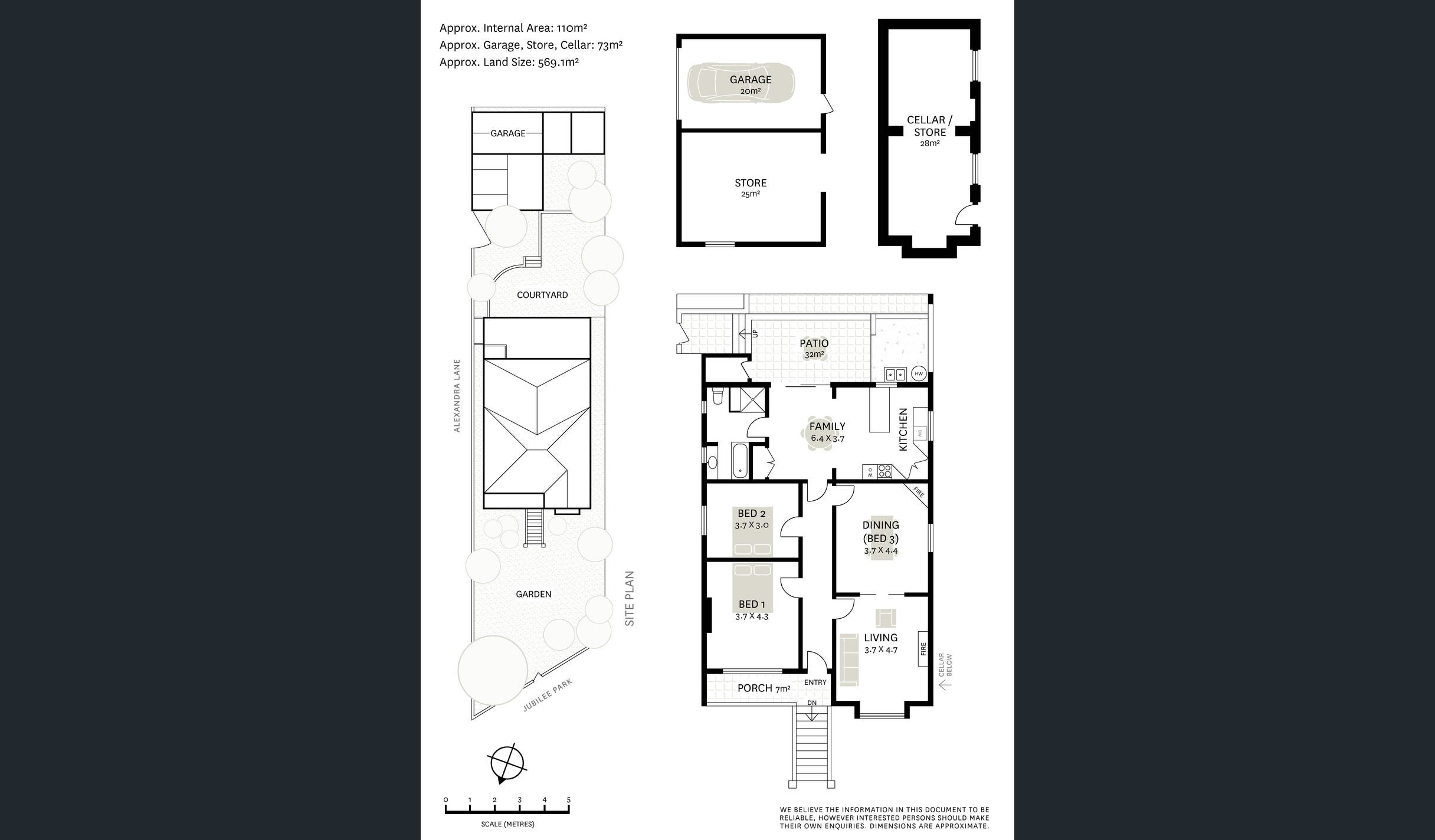

1 Alexandra Lane, Glebe

Glebe is positioned in the Inner West of Sydney, 3km west of the CBD. 1 Alexander Lane is a freestanding Victorian dwelling requiring a full renovation. Whilst currently in unliveable condition, mainly original character features remain.

The dwelling accommodates two / three bedrooms, one bathroom, combined living / dining, kitchen, rear garden and single lock up garage. The property is situated on 569sqm of land.

1 Alexander Lane shares a border with Jubliee Park, which provides access to Rozelle Bay foreshore. The property is in close proximity to Glebe's retail strip and Broadway Shopping Centre.

The property is likely to appeal to an owner-occupier looking to create their dream home, or a developer looking to explore the large land area for sub-division potential (subject to council approval).

The price guide is $3,900,000.

If you'd like to know more about this property or any others, please get in touch.