Greetings from Scoutable and welcome to our March Wrap Up.

I hope you are well.

Treasurer Josh Frydenberg announced the 2022-23 Federal Budget on Tuesday (29th March). Mr Frydenberg revealed a $78 billion deficit (3.4% of GDP).

The cost of living, with fuel prices surging, omicron and the effects from recent foods in NSW and Queensland, was given priority by the government. “The global pandemic is not over. Devastating floods have battered our communities. We live in uncertain times. The last two years have been tough for our country, there have been setbacks along the way." Mr Frydenberg said.

There will be a temporary six-month cut to fuel tax, reducing fuel excise by 50%, to 22.1 cents per litre. The government has also introduced a one-off $250 cash payment for pensioners, veterans, job seekers, carers, eligible self-funded retirees and concession card holders. Further, the government indicated a flood disaster relief and recovery spend of $6 billion across resident support measures, farming, small business and local councils.

Home ownership has also been a focus in this year’s budget. “Home ownership is fundamental to the Coalition,” Mr Frydenberg said in Tuesday night’s budget speech. “Helping more Australians to own a home is part of our plan for a stronger future.”

The budget has outlined the below allocation of money to housing.

Social Housing

The budget lifts the government-guaranteed liability cap of the National Housing Finance and Investment Corporation (NHFIC) by $2 billion, to $5.5 billion, increasing the low-cost financing it provides to community housing providers for affordable housing. The $2 billion increase will help to deliver around 8,000 more social and affordable dwellings. This is in addition to $500 million (2,500 dwellings) announced in December.

Home Guarantee Scheme expanded

The scheme allows homeowners to buy a property without needing to save a 20% deposit or having to pay lenders mortgage insurance. To be eligible, you need to be buying a home to live in (not investment), single applicants can have a taxable income of up to $125,000 per annum for the previous financial year, and couples with an income of up to $200,000.

The Home Guarantee Scheme will double to 50,000 places a year, including a new regional program. The budget papers noted there will be 50,000 guarantees per year for three years from 2022/23, and then 35,000 a year as an ongoing measure.

The scheme is divided into sub-sections.

The First Home Guarantee, which helps first-home buyers buy a new or existing home with a deposit as low as 5%, will provide 35,000 guarantees a year from 1 July.

The Family Home Guarantee, introduced in the 2021 budget to help single parents with children buy their first home or re-enter the market with a deposit as low as 2%, will also increase to 5000 places per year until 30 June 2025.

The Regional Home Guarantee will provide 10,000 places per year for first-home buyers and people who have not owned a home for five years. This scheme, which runs from 1 October 2022 until 30 June 2025, will help them buy a new home in a regional location with a minimum 5% deposit.

The scheme is a fantastic initiative, however, the property price caps limit the number of dwellings that are eligible. The price cap for Sydney is $800,000, where CoreLogic data puts the median price for all dwellings at $1.116 million. Melbourne's cap is $700,000, while its median dwelling sale price is $800,000; Brisbane has a cap of $600,000 with a $722,000 median; and Canberra's $500,000 cap is well below its $909,000 median.

Further, The New Home Guarantee, a temporary two-year extension of the scheme that provided an additional 10,000 places a year specifically for first-home buyers building or purchasing new homes, will end as planned on 30 June 2022.

As announced in last year’s budget, the maximum amount of voluntary contributions that can be released under the First Home Super Saver Scheme will increase to $50,000 from $30,000 from 1 July 2022.

Please get in touch if you would like to discuss the Home Guarantee Scheme, or any other property matters.

Until next month,

Kellie Landrey | Principal Buyers Agent

IN THE NEWS

PROPERTY WORTH $25B AT RISK FROM COASTAL EROSION

https://www.smh.com.au/property/news/property-worth-25b-at-risk-from-coastal-erosion-20220325-p5a82d.html

PRESTON MARKET REDEVELOPMENT PAUSED AFTER GOVERNMENT RETHINKS PRECINCT

https://www.theurbandeveloper.com/articles/developers-pause-aud75m-market-upgrade-after-government-rethinks-precinct

ONE OF AUSTRALIA'S OLDEST MANSIONS LISTED FOR SALE IN TASMANIA

https://www.domain.com.au/news/one-of-australias-oldest-mansions-listed-for-sale-in-tasmania-1127540/

PROPERTY OF THE MONTH

Unit 16, 30 Garden Street, Alexandria

The property of the month is a recent Scoutable purchase for one of our investor clients. The property is positioned in Alexandria, approximately 4km south of the CBD.

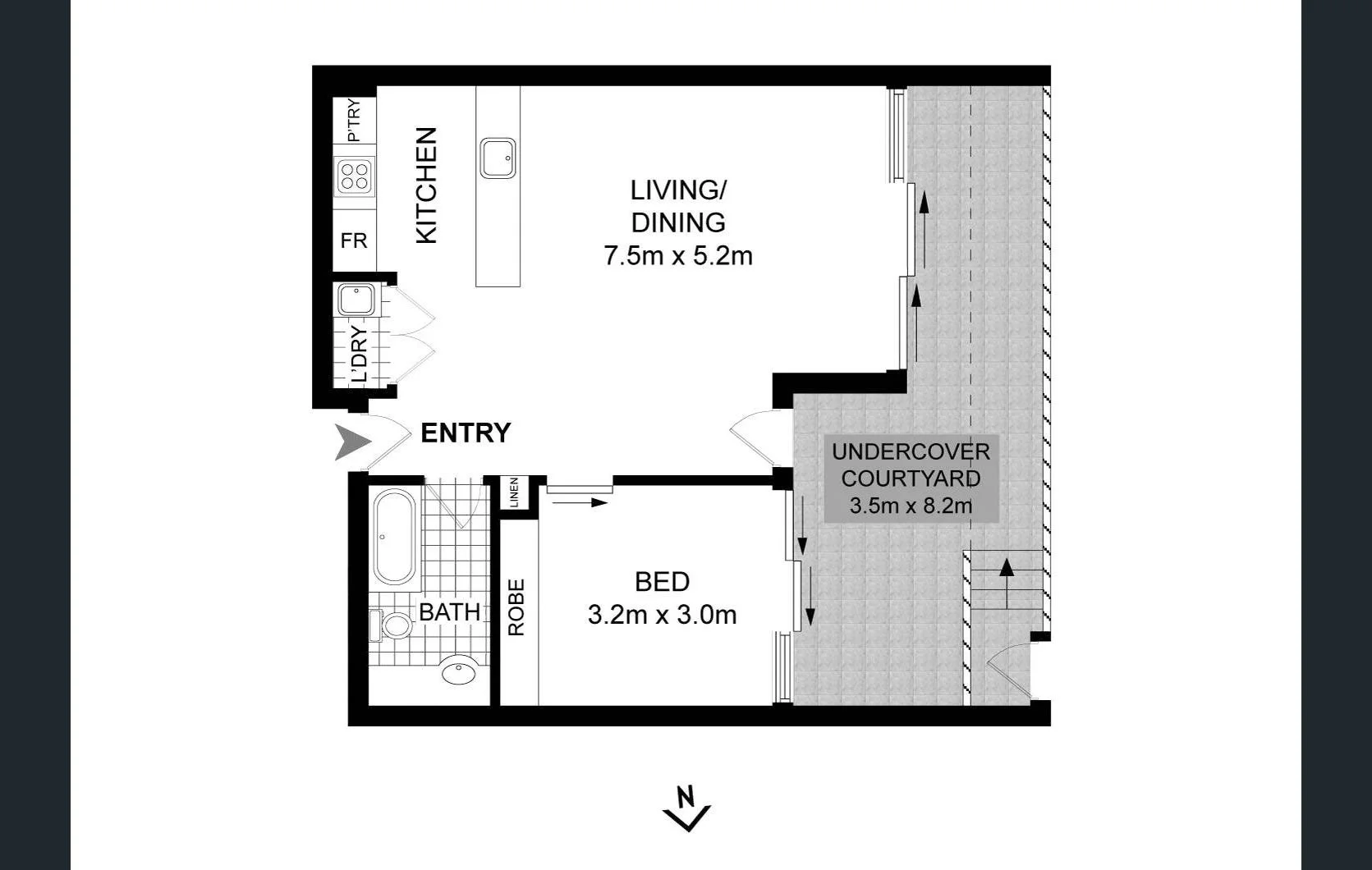

30 Garden Street is a complex of 45 apartments over four levels, built in 2005. Unit 16 is situated on the ground floor providing one bedroom, open plan kitchen / living / dining, one bathroom, laundry cupboard and courtyard with private entrance. The property is 74sqm including the courtyard.

Whilst the property is noted as an Alexandria address, it is closer to the border of Redfern & Eveleigh. The apartment is around 2.5km to CBD, 450m to Redfern train station and 300m to the Waterloo metro station (to be completed in 2024). The property is across the road from the redeveloped South Eveleigh precinct, providing multiple retail and restaurant facilities, along with CBA's new office space. All the above factors provide strong fundamentals for capital growth, along with the small complex size and oversized interiors.

The property was purchased for just over $700,000. The expected rental is $550 per week, reflecting an excellent 4% gross yield.

If you'd like to know more about this property or any others, please get in touch.