Greetings from Scoutable and welcome to our May Wrap Up.

CoreLogic’s Home Value Index (HVI) has shown combined capitals property prices fell by 0.3% in May, with Sydney (-1%), Melbourne (-0.7%) and Canberra (-0.1%) leading the decline.

According to CoreLogic, since peaking in January, Sydney housing values remain 22.7% above pre-COVID levels. Comparatively, Melbourne, which experienced a softer growth phase, has recorded a smaller peak-to-date decline of -0.8%, with housing values now 9.8% higher compared to the pre-COVID level. Accounting for the marginal decline evident in May, Canberra housing values remain 37.9% higher vs. pre-pandemic levels.

The main factors contributing to the falling prices are a combination of reduced home buyer confidence, higher interest rates (& expectations of further rises in the immediate future) and increasing stock levels.

Shane Oliver, AMP’s head of investment strategy and their chief economist, said “The main driver of the downturn is the upswing in interest rates. With fixed mortgage rates roughly doubling during the past 12 months combined with an increase in the interest rate serviceability buffer from 2.5 to 3 per cent, this has substantially reduced the amount new home buyers can borrow and hence their capacity to pay. National average property prices have likely now peaked and we continue to expect a peak-to-trough fall of around 10 to 15 per cent, reflecting the combination of poor affordability, rising fixed mortgage rates, and monetary tightening from the RBA pushing up variable rates by around 2 per cent out to mid-next year.”

Household balance sheets are likely to be sensitive to rising interest rates as housing debt to housing income ratio is at record highs. Further, high inflation could contribute to softer property growth conditions as households spend more on everyday items.

However, Mr Lawless, Head of Research - CoreLogic, notes several mitigating factors as well. “Labour markets are tightening, sending the unemployment rate to generational lows and placing additional upwards pressure on wages growth. As income growth outpaces housing values, the home deposit hurdle will gradually lessen, reducing one of the key barriers to entry for home buyers. Strong labour market conditions, together with a growing economy will help to contain mortgage arrears and mitigate some risk of a surge in forced sales placing additional downwards pressure on housing values.”

As mentioned in April’s wrap up, many households are ahead of their mortgage repayments, reducing the potential influx of distressed listings due to interest rate movements. Further, mortgage serviceability assessments had been set at 2.5 percentage points higher than the origination rate and since October last year, the assessment rate increased to a buffer of 3 percentage points.

Investors are taking note as rents continue to rise. According to the data from CoreLogic, the annual change in rents across the combined capital cities is currently sitting at 8.8%. Unit rents are rising at a faster annual pace than house rents across the combined capital cities (where house rents increased 8.6% compared to 9.1% across units).

“Early in the pandemic rental demand for medium to high density dwellings fell sharply due to a preference shift towards larger homes and a demand shock from closed international borders,” Mr Lawless said. “As rental affordability pressures mount, demand for higher density rentals has steadily grown due to the unit sectors’ relative affordability advantage. More recently, demand has been boosted by international arrivals returning to the rental market.”

If you would like to discuss the current market conditions further, please get in touch.

Until next month,

Kellie Landrey | Principal Buyers Agent

IN THE NEWS

HOUSE PRICES FALL FOR THE FIRST TIME IN NEARLY TWO YEARS

https://www.abc.net.au/news/2022-06-01/house-price-index-corelogic-proptrack-may-2022/101114444

HOUSING APPROVALS DOWN 32PC AS MARKET SOFTENS

https://www.theurbandeveloper.com/articles/housing-approvals-down-32pc-as-market-softens

THE SYDNEY HOME THAT EARNED ALMOST $6000 A DAY

https://www.domain.com.au/news/the-sydney-home-that-earned-almost-6000-a-day-2-1142120/

PROPERTY OF THE MONTH

7/4 Glen Street, Hawthorn

Hawthorn is situated in the Inner East of Melbourne, approximately 7km from the CBD. Hawthorn is known for its Victorian architecture with many dwellings built in the late 1800s remaining intact today. Hawthorn's retail facilities along Glenferrie Road and access to public transport via two train stations and trams, add to the suburb's appeal to both occupiers and investors.

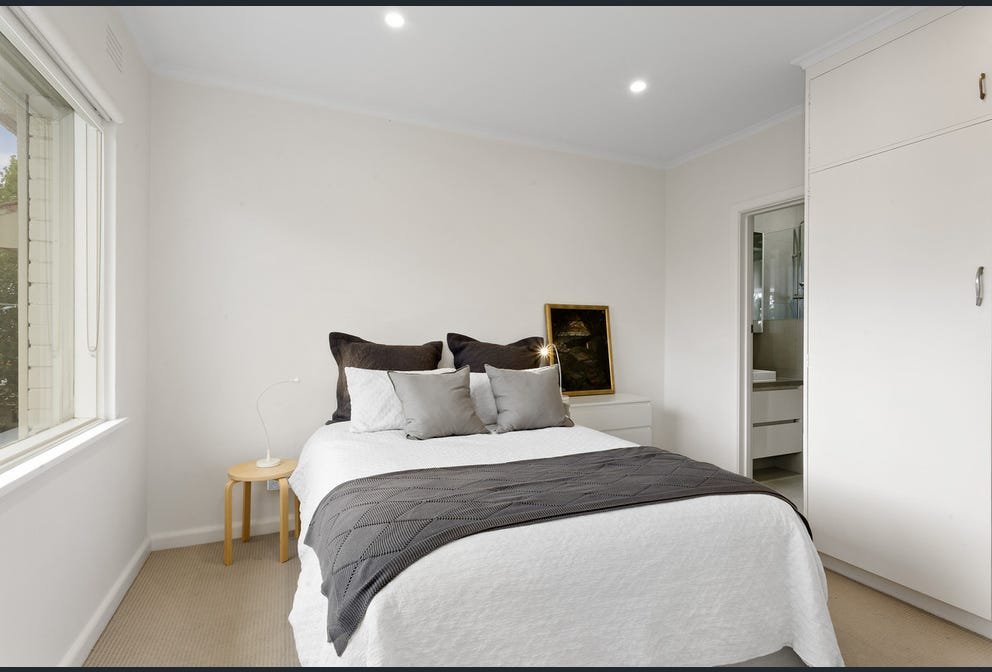

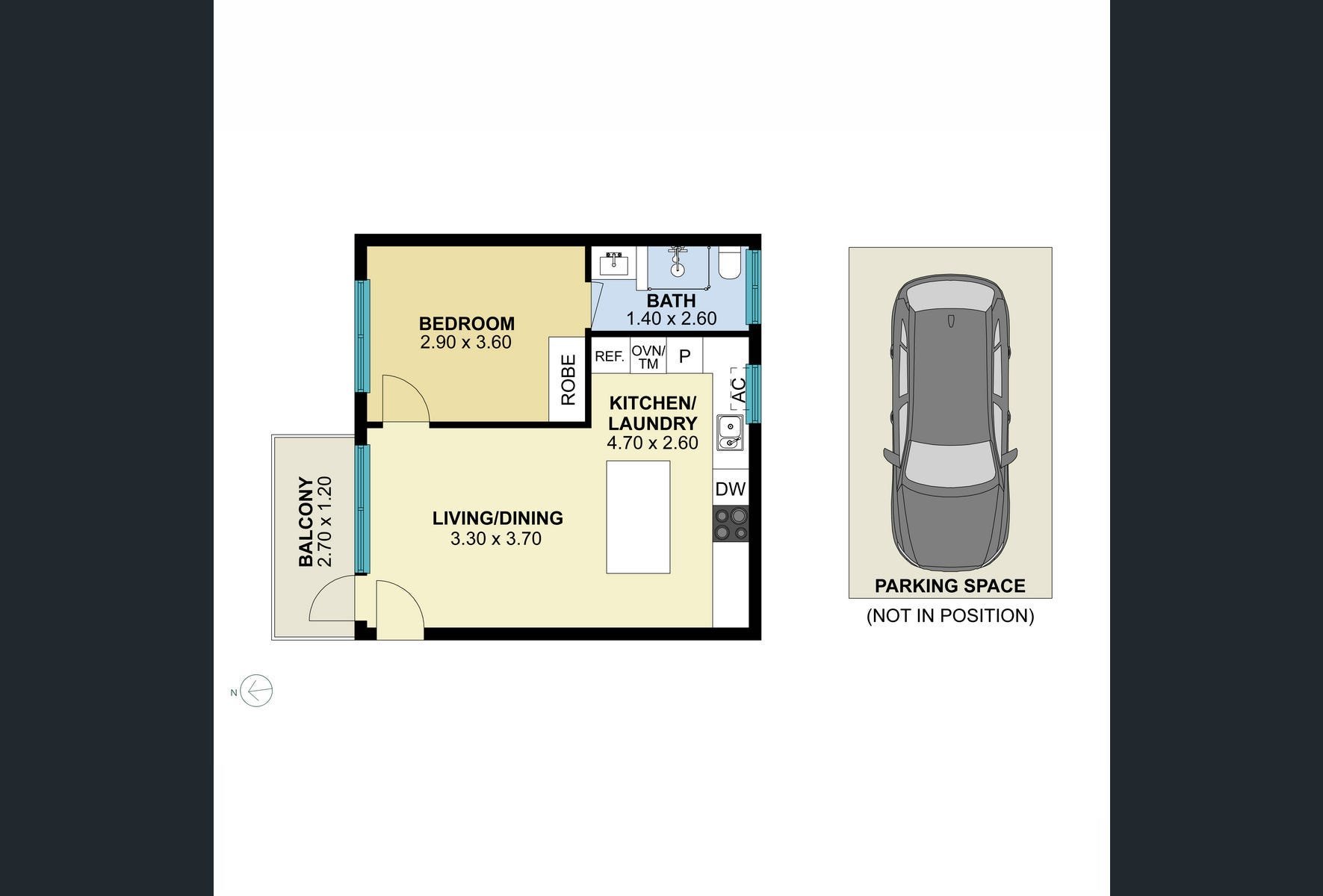

The property of the month was a recent purchase for an investor client. 4 Glen Street is a 1960s complex of twelve apartments. Unit 7, positioned on the top floor, is single level, comprising one bedroom, open plan kitchen (incorporating laundry) / living / dining, balcony and parking for one car. The apartment faces north.

Purchased for $415,000, with an estimated rental return of $380 per week, provides a 4.8% gross yield.

If you'd like to know more about this property or any others, please get in touch.