Greetings from Scoutable and welcome to our June Wrap Up.

I hope you and your loved ones are well.

NSW treasurer, Matt Kean, announced the 2022-23 NSW Budget on the 21st June. $728 million has been allocated as part of the state government's housing affordability package. The NSW Government is finally embarking on the long talked about stamp duty reform. However, it's not as broad as originally discussed over recent years. The NSW Government will be offering some first home buyers the choice of making the current up-front payment or opting into an annual property tax.

NSW Premier, Dominic Perrottet, has made it clear that he would like to transition to a property-tax-based regime for the majority of property buyers in NSW, but conceded before this release that doing so would require federal support.

NSW collected about $9.4bn in stamp duty last financial year, making up about 28% of the state’s total tax revenue. The state’s 2022-23 budget earmarked $728 million over the next four years to account for the expected shortfall in revenue.

KEY INFORMATION

What is stamp duty?

Stamp duty is a tax charged by state and territory governments on property purchases, paid at the time of purchase. The rate will vary depending on the location and the value of the property but currently in New South Wales it is roughly 3-4% of the purchase price. For example, a property purchased for $1m, the stamp duty payable is $40,335.

According to the government, stamp duty adds two years to the time required to save for a home deposit (based on someone with a median household income of $1,786 per week, putting 15% of their income into deposit savings).

Currently, first homebuyers have stamp duty exemption for properties valued up to $650,000, and concessions for properties between $650,000 and $800,000. These concessions will remain available for first homebuyers.

How much is the property tax?

$400 plus 0.3% of the land value of the property per year.

When is it available?

Property tax legislation will need to pass NSW parliament. It would be introduced in the second half of 2022, with eligible first homebuyers able to apply from 16 January 2023.

For contracts exchanged in the period between enactment of the legislation and 15 January 2023, eligible first home buyers will be able to opt-in from 16 January 2023 and receive a refund of any stamp duty paid.

NSW Labor has indicated it is opposed to the scheme, with the shadow treasurer, Daniel Mookhey, saying it would lead to families being charged annual land tax on their family home that “will last forever”.

Who is eligible for the annual property tax?

First home buyers who purchase a home as an owner occupier up to $1.5m in value.

Comparing stamp duty versus land tax, Domain’s Chief of Research and Economics, Dr Nicola Powell, said "It could take years to accrue the same amount of property tax compared to the upfront cost of stamp duty. Based on the median house price in Sydney sitting around $1.5 million, it would have to be owned for approximately 18 years before the owner would match the upfront cost of stamp duty”.

The NSW government has estimated that about 97% of first homebuyers in the state, or around 55,000 people per year, will be eligible.

What happens when you sell?

Only first homebuyers are eligible to pay the property tax. Stamp duty otherwise continues as normal. If you’re buying a property from someone paying property tax, you won’t pay the tax, but will pay stamp duty – unless you are a first homebuyer opting into the property tax scheme.

If you would like to discuss the tax reforms or any other property matter further, please get in touch.

Until next month,

Kellie Landrey | Principal Buyers Agent

IN THE NEWS

WILL HOUSING BECOME ANY MORE AFFORDABLE THIS YEAR?

https://www.smh.com.au/property/news/will-housing-become-any-more-affordable-this-year-20220628-p5ax8k.html

ONE MILLION HOMES WERE UNOCCUPIED ON CENSUS NIGHT. HOW THAT COULD HELP PEOPLE STRUGGLING TO FIND HOUSING

https://www.abc.net.au/news/2022-06-29/census-finds-1-million-empty-houses-amid-affordability-crisis/101190794

LUXURY HARRINGTON PENTHOUSE WITH $40M GUIDE WOWS SYDNEY'S ELITE

https://www.realestate.com.au/news/luxury-harrington-penthouse-with-40m-guide-wows-sydneys-elite/

PROPERTY OF THE MONTH

Unit 1, 8 Beaumond Avenue, Maroubra

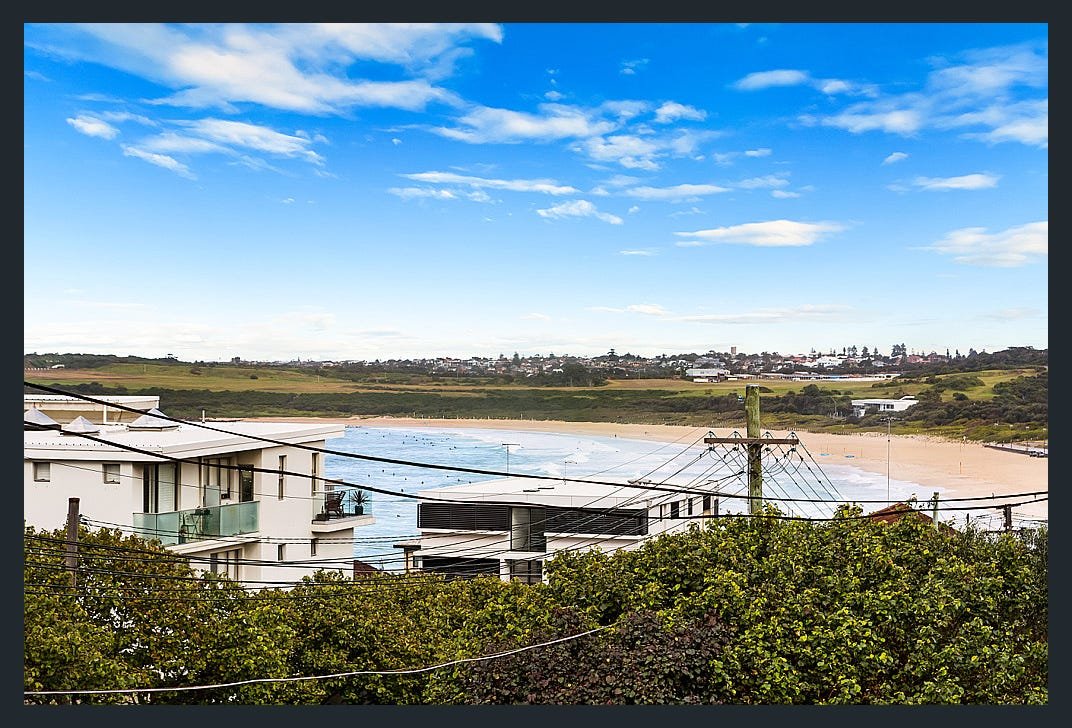

Properties in the Eastern suburbs of Sydney are often considered blue chip investments. This is due to their proximity to the CBD, limited supply of properties, character filled suburbs, access to public transport, retail facilities and beaches. Maroubra & neighbouring Coogee are often overlooked for the more known beachside suburbs of Bondi, Bronte and Tamarama.

Whilst Maroubra has undergone significant gentrification over the last five years, we believe that there is potential for above average capital growth due to the current & continued undervaluation of the suburb.

June’s property of the month is a prime example of a solid investment in Maroubra. Apartment 1, 8 Beaumond Avenue is located approximately 11 kilometres south-east of the CBD and 450 metres to the beach.

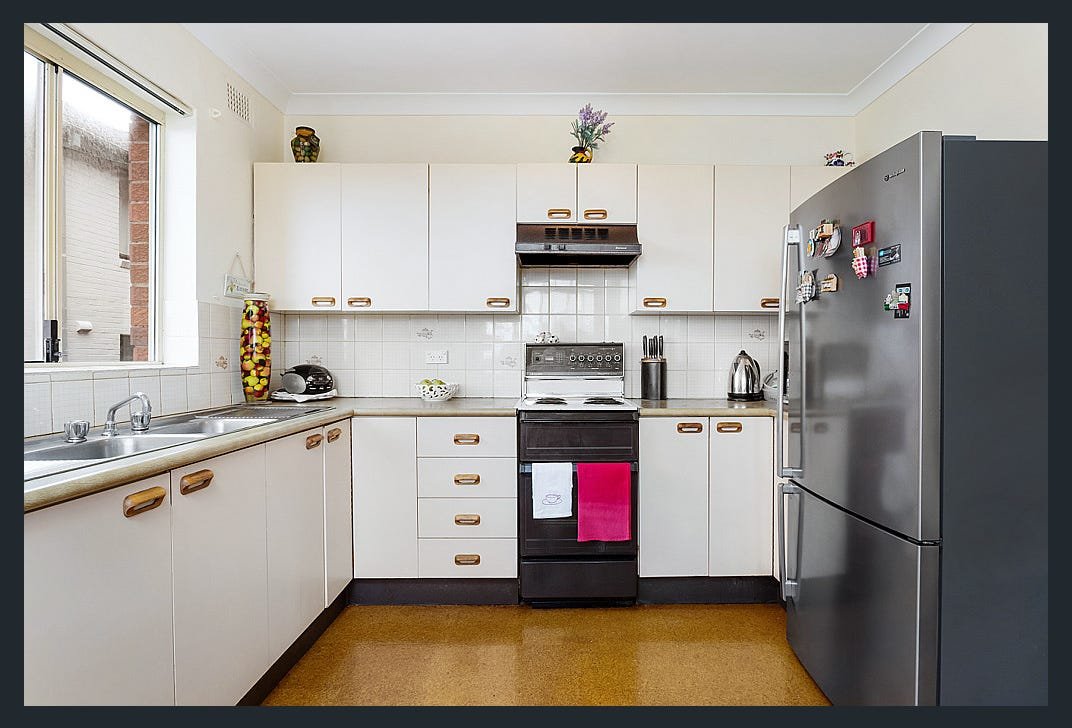

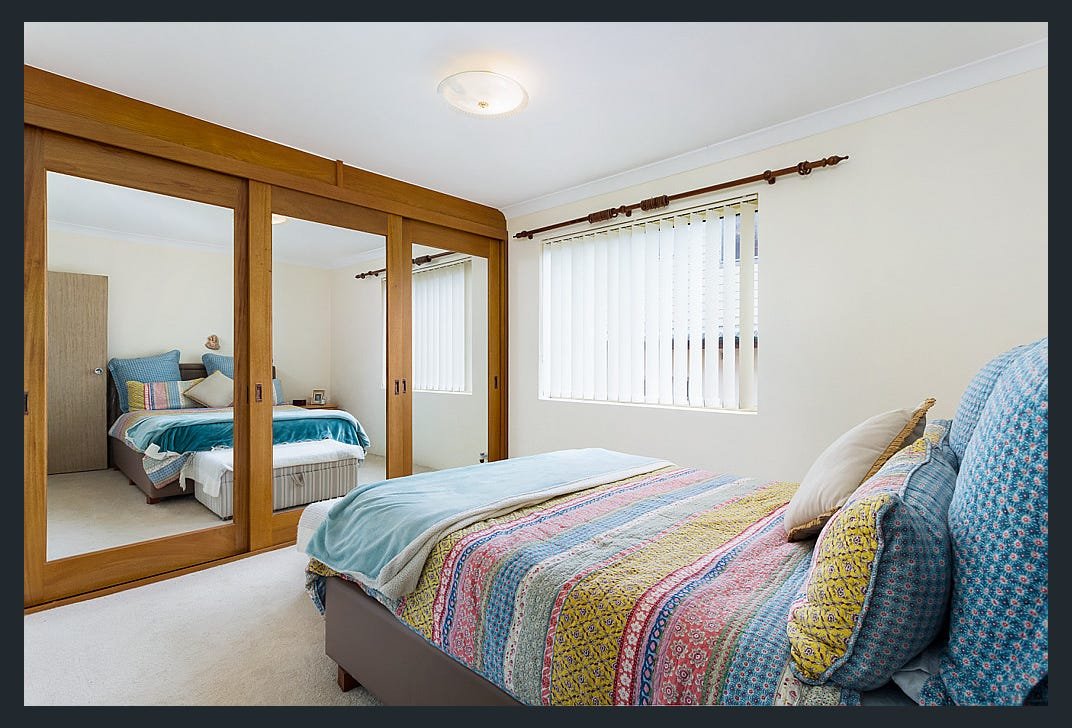

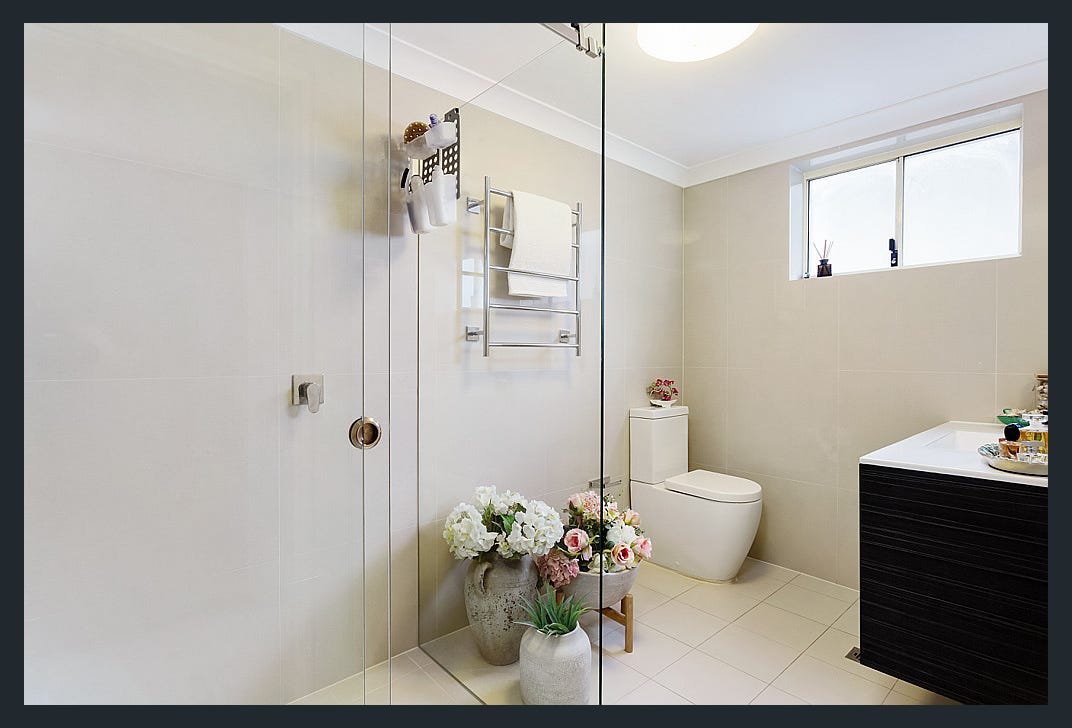

The property is a single level apartment positioned on the first floor of a 1970s complex consisting of nine apartments over three storeys. The apartment comprises two bedrooms, one bathroom, living, eat-in kitchen, enclosed balcony with ocean views and oversized single lock up garage. The apartment is 92sqm + 31sqm garage. Whilst the property is presented in rentable condition, value can be added through refurbishment and renovations. The property is for sale with a guide of $1.3m and a rental guide of $700 - $750 per week.

If you'd like to know more about this property or any others, please get in touch.