Greetings from Scoutable and welcome to our July Wrap Up.

Yesterday, the Reserve Bank (RBA) increased the cash rate by 0.5 of a percentage point, the fourth increase in as many months. This results in a total increase of 1.75 percentage points to date, with the cash rate sitting at 1.85 percentage points. Figures from RateCity show the latest rate rise, if passed on in full by banks, will add another $140 a month to repayments on a $500,000 home loan. Since rates started rising on May 3, someone with a $500,000 loan would be paying $472 a month more if their bank had simply matched the RBA moves.

In his post-meeting statement, Reserve Bank governor Philip Lowe said the latest rate rise was unlikely to be the last this year. "The board expects to take further steps in the process of normalising monetary conditions over the months ahead, but it is not on a pre-set path," he said. "The size and timing of future interest rate increases will be guided by the incoming data and the board's assessment of the outlook for inflation and the labour market. The board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time”.

CoreLogic’s Hedonic Home Value Index, reported a national fall of 1.3% in dwelling values in July, making it the third consecutive month of declining values in July. After national dwelling values surged 28.6% through the pandemic growth phase, values are now -2.0% below April’s peak. Please see table below for percentage change in dwelling values for each capital city.

CoreLogic’s Research Director, Tim Lawless, commented: “The rate of growth in housing values was slowing well before interest rates started to rise, however, it’s abundantly clear markets have weakened quite sharply since the first rate rise on May 5." "Due to record high levels of debt, indebted households are more sensitive to higher interest rates, as well as the additional downside impact from very high inflation on balance sheets and sentiment".

Tim Lawless commented further: “On a more positive note, this interest rate hiking cycle may be short and sharp, with financial markets and some economic forecasters now factoring in interest rate cuts through the second half of next year. When interest rates start to stabilise, or potentially reduce next year, this could be the cue for housing values to find a floor,” Mr Lawless said. “Similar to the trajectory of the upswing, this downswing phase could be a short but sharp one, depending on how high and fast interest rate settings go.”

Many clients are asking if it is the right time to buy. I am always commenting that property is a long-term investment. The property market does have short term movements. For buyers who have reviewed their finances based on the expected rate rises for the remainder of the year and adjusted their budget accordingly, there are good deals out there, especially in the off-market platform. But what if the market falls further? It might. It is hard to say what exactly will happen in six months’ time (remember how every forecast got it wrong with COVID & price movements). If the market does fall further, you should make up any shortfall over the lifetime of the investment. The tricky part of picking when it is the bottom of the market, is that no one knows it is the bottom until prices start to increase. The important questions to ask yourself are..... Is this the right property for me? Is the financial commitment manageable? If yes, then go forth and find that great opportunity (or let us do it for you). If you are feeling unsure, then wait.

If you would like to discuss the current market conditions in more detail or are looking to buy property in Australia, please get in touch to learn about Scoutable's services and how we can assist with your property search.

Until next month,

Kellie Landrey | Principal Buyers Agent

IN THE NEWS

HOW MUCH EXTRA COULD MORTGAGE REPAYMENTS COST NOW THE CASH RATE IS 1.85 PER CENT

https://www.abc.net.au/news/2022-08-02/mortgage-rate-rise-calculator-interest-rates-loan-rba-repayment/101290680

AUSTRALIAN PROPERTY PRICES REMAIN STUBBORN, CLING TO PRE-COVID LEVELS

https://www.news.com.au/finance/real-estate/buying/australian-property-prices-remain-stubborn-cling-to-precovid-levels/news-story/25be21c625e8da62d5a5d7f57c9bff97

SYDNEY'S THE OAKS HOTEL ON MARKET FOR $175M

https://www.theurbandeveloper.com/articles/the-oaks-neutral-bay-sydney-for-sale

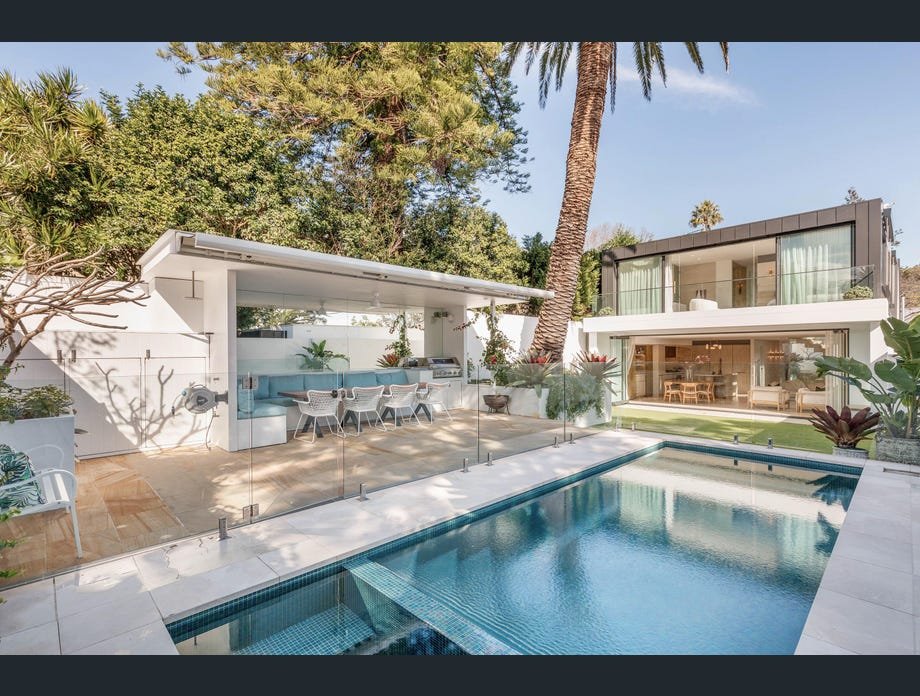

PROPRTY OF THE MONTH

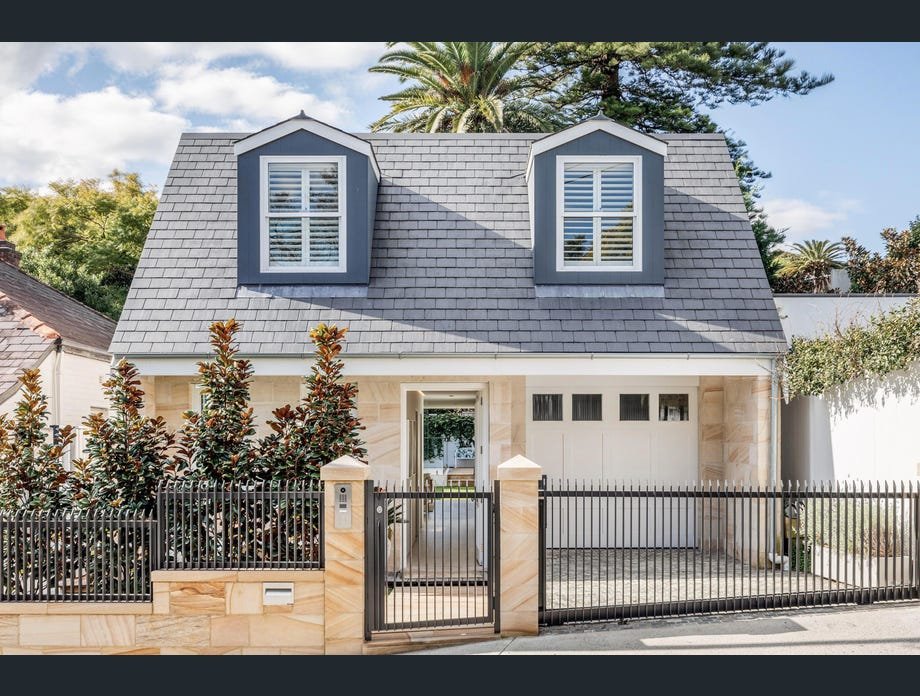

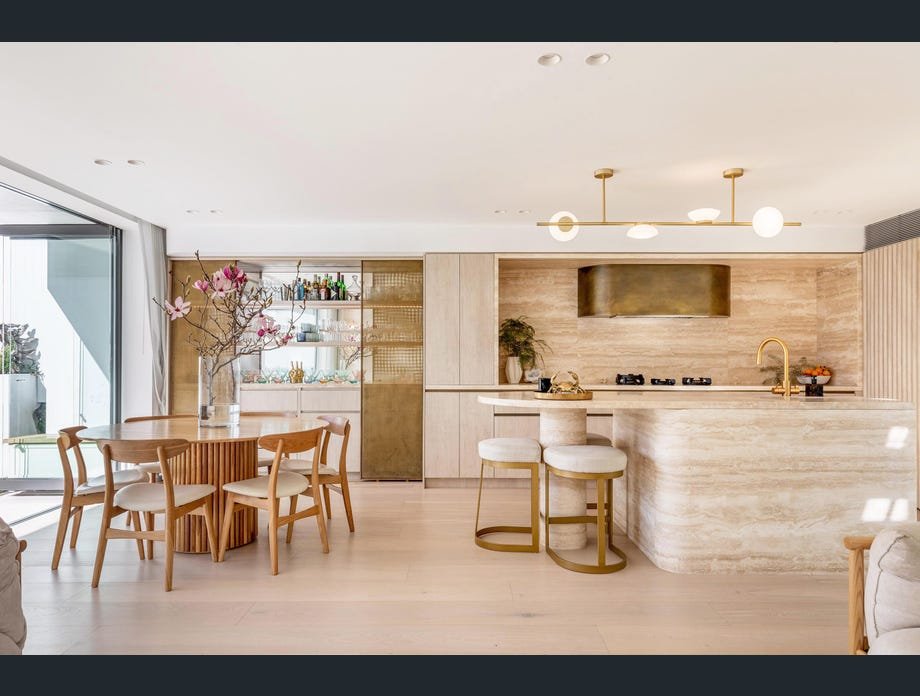

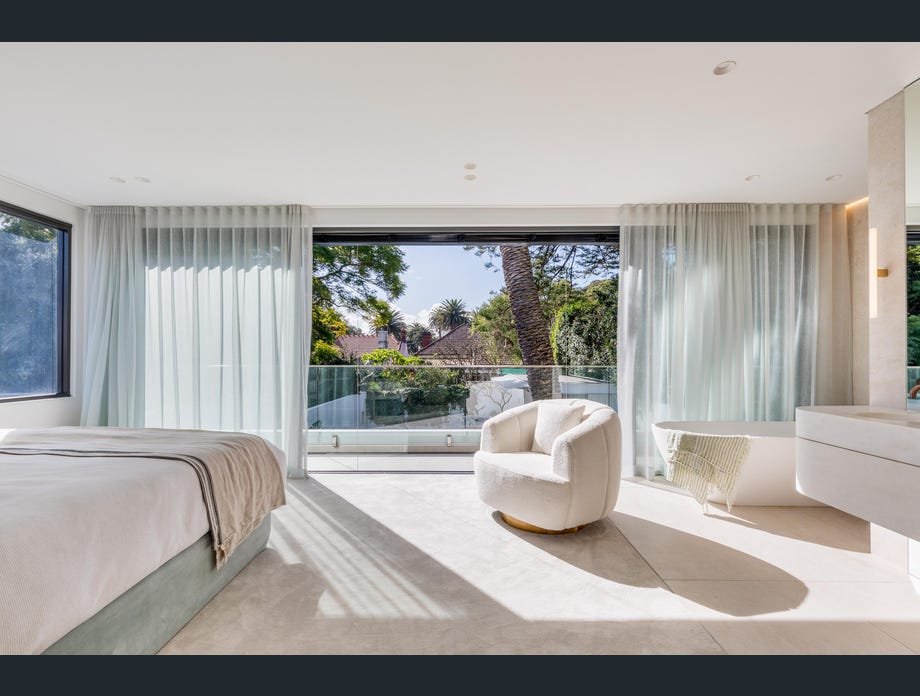

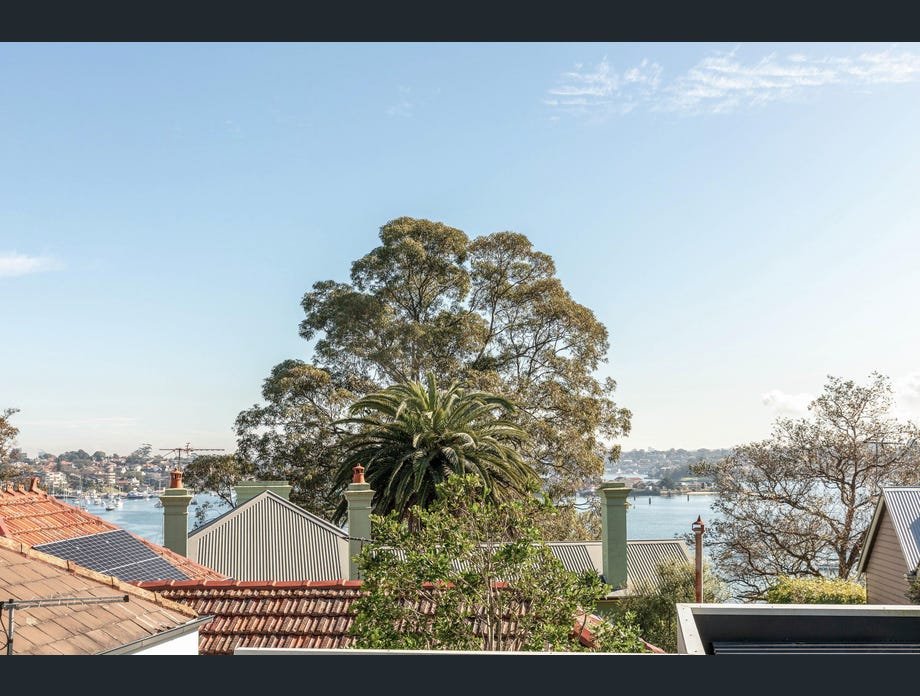

1 CARIEVILLE STREET, BALMAIN

Balmain, located in Sydney’s inner west, is positioned 2km west of the CBD. Traditionally a blue collar suburb, Balmain has gentrified into one of Sydney’s most desired suburbs due to its proximity to the CBD, retail amenities and waterfront location.

1 Carieville Street is an example of the old and new. Hiding behind its humble character façade, the three-level home set on 320sqm of land, offers 300sqm of internal living space. The property provides four bedrooms (or three plus study), four bathrooms, open plan living / kitchen / dining, cinema, gym and games / rumpus room, laundry, rear lawn and swimming pool with outdoor dining and lock up garage with internal access.

The price guide is $6,500,000.

If you'd like to know more about this property or any others, please get in touch.