Greetings from Scoutable and welcome to our October Wrap Up.

I hope you are well.

The Reserve Bank of Australia raised the cash rate yesterday by another 25 basis points to 2.85%, the highest it has been since May 2013 and up from the record low of 0.1% at the start of May this year.

CoreLogic’s national home value index fell 1.2% in October, as shown in the table below.

The pace of falls has eased in Sydney and Melbourne. However, Brisbane home values are falling the most rapidly of any capital city or rest-of-state region.

According to CoreLogic, at the combined capital city level, housing values have fallen 6.5% from the recent peak following a 25.5% rise through the upswing. Sydney home values are down 10.2% since peaking in January (after a 27.7% rise) and Melbourne values down 6.4% since February (after rising 17.3%). CoreLogic’s research director, Tim Lawless, commented “Despite the easing in the pace of decline, with Australian borrowers facing the double whammy of further interest rate hikes along with persistently high and rising inflation, there is a genuine risk we could see the rate of decline re-accelerate as interest rates rise further and household balance sheets become more thinly stretched.”

CoreLogic’s Housing values outlook

Housing values are likely to continue trending lower until interest rates find a ceiling. Mainstream forecasts for the terminal cash rate range from 3.1% to 3.85%, while financial markets are pricing in a peak cash rate closer to 4%.

At the low end of these forecasts, a 3.1% cash rate implies an average variable owner occupier mortgage rate of around 5.21% for new borrowers and 5.69% for existing borrowers, adding approximately $1,195 to $1,420 a month to mortgage repayments relative to pre-rate hike mortgage costs on a $750,000 principal and interest loan on a 30-year term. It will not be long before these serviceability limits are tested.

Tight labour markets, increased net overseas migration, tight rental markets / rising yields and good household savings should provide a buffer to higher mortgage rates and keep this downturn orderly and stave off a material rise in distressed listings.

If you would like to discuss the current market conditions, or have any general property questions, please get in touch.

Until next month,

Kellie Landrey | Principal Buyers Agent

IN THE NEWS

RESERVE BANK STICKS TO SMALLER INTEREST RATE HIKE DESPITE INFLATION SHOCK

https://www.abc.net.au/news/2022-11-01/rba-interest-rates-25-basis-point-hike-melbourne-cup-day/101602250

FEDERAL BUDGET 2022: A MILLION NEW HOMES AS PART OF A BOLD PARTNERSHIP - BUT THERE'S A BIG CATCH

https://www.realestate.com.au/news/federal-budget-2022-a-million-new-homes-as-part-of-bold-partnership-but-theres-a-big-catch/

WALLABIES PUB KING BILL YOUNG LISTS NORTHWOOD PRIZE

https://www.domain.com.au/news/wallabies-pub-king-bill-young-lists-northwood-prize-1178994/

PROPERTY OF THE MONTH

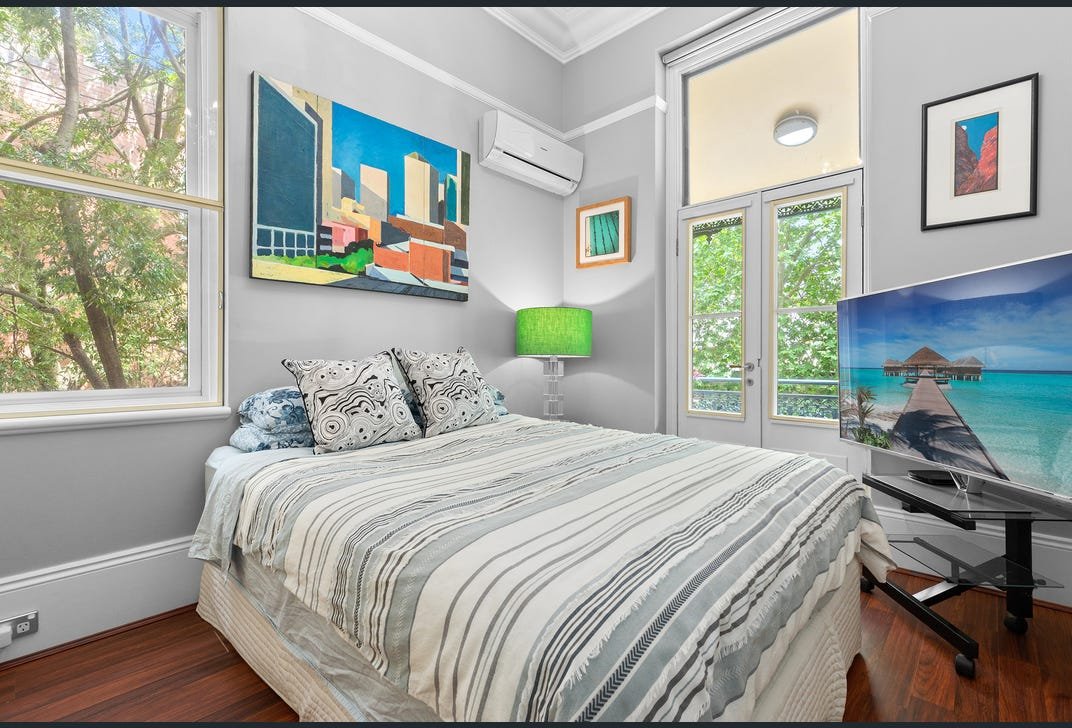

UNIT 1, 128 VICTORIA STREET, POTTS POINT

Potts Point is located approximately 2km east of the Sydney CBD. The suburb is rich with late 1800 / early 1900s architecture. Potts Point was the site of some of Australia's earliest blocks of flats, and from the 1920s through to World War II, the area was intensively developed. As a result, it boasts the highest concentration of Art Deco architecture in Australia.

The suburb attracts a vast range of buyers, from down-sizers to first home buyers, executives, families and investors. Armed with a train station (Kings Cross) and bus network, Potts Point is also within walking distance to the CBD and the harbour front. It is also known for its multitude of upmarket restaurants. These factors attribute to making the area a great place to live and a smart area to invest in.

Unit 1, 128 Victoria Street is an excellent example of a beautiful terrace found in the area. The terrace was built in the 1880s, converted into six apartments in the 1990s. Unit 1 is dual level apartment positioned on the ground and first floor, comprising two bedrooms, one bathroom, open plan kitchen / living / dining, verandah and balcony. The apartment is approximately 65sqm plus outdoor spaces. The property is for sale for $1,375,000. The property would appeal to owner-occupiers and investors, with a rental guide of $900 per week, resulting in a gross yield of 3.4%.

If you'd like to know more about this property or any others, please get in touch.