Greetings from Scoutable and welcome to our September Wrap Up.

I hope you are well.

The Reserve Bank of Australia raised the cash rate yesterday by another 25 basis points to 2.60%, which is the highest level it's been in over nine years. This is the sixth successive rate increase since May. Yesterday's increase was a smaller move as most experts were expecting a rise of 50 basis points. A welcome news for borrowers!

CoreLogic’s national home value index fell 1.4% in September, as shown in the CoreLogic table below. Although values continue to trend lower, the rate of decline eased from a 1.6% fall in August.

It is too early to know if the market has moved through the worst of the downturn. CoreLogic’s research director, Tim Lawless, commented, “It’s possible we have seen the initial shock of a rapid rise in interest rates pass through the market and most borrowers and prospective home buyers have now ‘priced in’ further rate hikes. However, if interest rates continue to rise as rapidly as they have since May, we could see the rate of decline in housing values accelerate once again.”

Along with the reduced rate of decline, other improving market indicators include a slight rise in auction clearance rates and strong labour market conditions assisting positive consumer sentiment. Stock levels are still trending lower, especially for the beginning of spring. The number of new listings added to capital city housing markets over the four weeks ending September 25th was 12% lower than the same period last year and 10% below the previous five-year average. The low stock levels are assisting the subtle reduction in the rate of decline through September.

Data from CoreLogic shows that after rising 25.5% over the recent growth cycle, housing values across the combined capitals index are now 5.5% below the recent peak. The most important factor influencing housing markets will be the trajectory of interest rates, which remains uncertain. Once interest rates stabilise, housing prices are likely to find a floor.

If you would like to discuss the property market further, please get in touch.

Until next month,

Kellie Landrey | Principal Buyers Agent

IN THE NEWS

PROPERTY PRICES DROP NATIONALLY AGAIN, WITH SYDNEY DIVING 6% ANNUALLY AND REGIONAL AUSTRALIA TO FOLLOW

https://www.abc.net.au/news/2022-10-03/property-prices-corelogic-rents-september-2022/101495078

FURY ERUPTS OVER QUEENSLAND'S 'LAZY' NEW HOUSING TAX AS ANNASTACIA PALASZCZUK DIGS IN

https://www.theurbandeveloper.com/articles/australia-building-approvals-august-2021

MIRVAC TO KICK OFF HARBOURSIDE REDEVELOPMENT IN JANUARY

https://www.commercialrealestate.com.au/news/mirvac-to-kick-off-harbourside-redevelopment-in-january-1167921/

PROPERTY OF THE MONTH

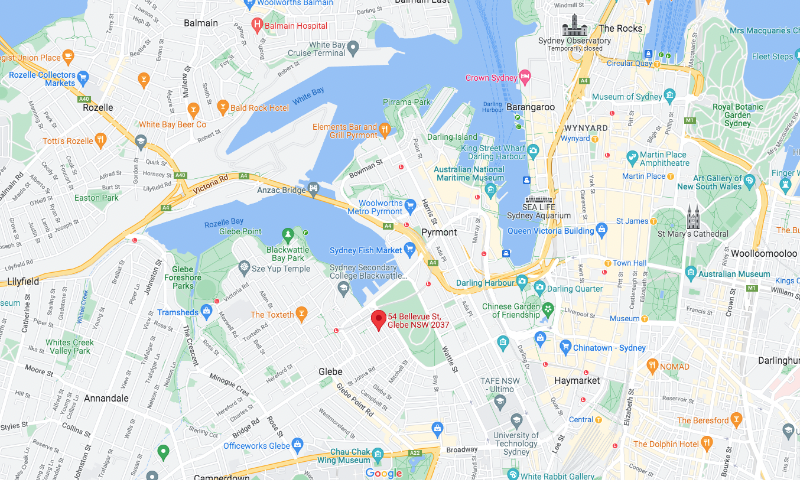

54 BELLEVUE STREET, GLEBE

54 Bellevue Street, Glebe, known as 'Bellevue', is positioned 2.5km west of Sydney's CBD. The property is within walking distance to Sydney Fish Markets which is currently undergoing significant redevelopment. Glebe offers easy access to the CBD, multitude of parklands, including Blackwattle Bay Park, and retail facilities making it an ideal location for owner occupiers and investors alike.

'Bellevue' comprises three separate buildings, integrated to create a unique private residence, positioned on 489sqm of land with a 17.8 metre frontage. A former broom factory complete with stables and billiard hall attached to a grand Victorian terrace erected in 1895. The property comprises four bedrooms, four bathrooms, seperate study areas, combined living / dining, kitchen, courtyard with swimming pool and cabana. The master bedroom provides CBD skyline views. There is rear lane access to a double garage with internal access.

The property is for sale off market with a price guide of $6,000,000.

If you'd like to know more about this property or any others, please get in touch.Z